Last updated on May 3rd, 2022 , 08:26 am

Jump To

VIX Definition: In the stock market, VIX is the ticker symbol for Chicago Board Options Exchange’s CBOE Volatility Index. This “fear gauge” index measures expected stock market volatility using options (derivatives) on the S&P 500 index.

VIX Option Nuances

In this section, we’ll cover two of the biggest VIX option nuances:

1) VIX options are not priced to the Index because the VIX does not have any tradable shares. Instead, VIX options are priced to the volatility future with the same settlement date.

2) VIX options settle to a Special Opening Quotation (SOQ) under the ticker symbol VRO. VRO is a VIX-style calculation that uses the opening prices of SPX options on the morning of settlement.

Care to watch the video instead? Check it out below!

TAKEAWAYS

- VIX index options are priced to VIX futures.

| - VIX options are settled European style; this means settlement is done in cash and early exercise/assignment is not possible.

- Long-term VIX options are less sensitive to changes in implied volatility than short-term options.

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

VIX Options Are Priced to VIX Futures, Not the VIX Index

One of the biggest nuances of options on the VIX is that they are not priced to the VIX Index. Why is this?

The VIX Index can’t be traded directly, so there are no shares that can be traded to keep the VIX option prices in-line with the Index.

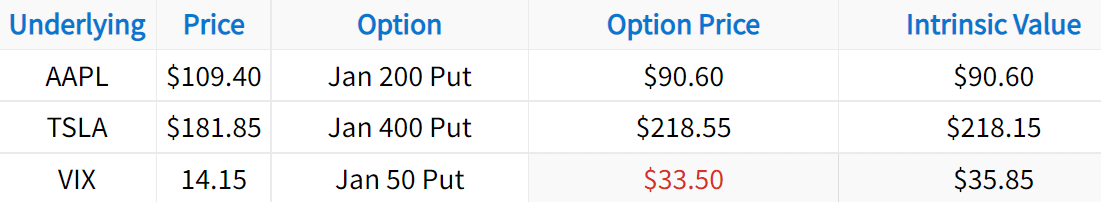

To demonstrate this, we can examine the intrinsic value of deep-in-the-money options on various products:

An option must be worth at least the amount of its intrinsic value. Because of this, something is clearly not right between the price of the VIX put and the VIX index.

If we look at the price of the VIX future with the same settlement date as this put option, the intrinsic value problem will no longer exist:

As we can see, the deep-in-the-money January VIX put is priced almost perfectly to the price of the January volatility future. So, don’t be fooled by any potential “mispricings” when examining options on the VIX.

To hammer this point home one last time, we’ll visually compare the prices of the VIX index and the cost of a long synthetic stock position (strike price of synthetic + cost of synthetic) on the VIX. A long synthetic stock position consists of a long call and short put at the same strike price, and in the same expiration. As the name suggests, a synthetic stock position should replicate a position in the underlying shares.

On the VIX, this means the synthetic should track the underlying product price (the VIX) very closely. Let’s take a look at the long synthetic in VIX options compared to the VIX Index:

Clearly, the cost of the long synthetic does not match up well with the price of the index, as it would with standard equity options on non-dividend stocks. However, if we add in the price of the future that corresponds to the options on the VIX, they should track each other almost perfectly:

Note that any subtle differences between the price of the synthetic stock position and the VIX future can be attributed to using the mid-price of the options in the synthetic and the mid-price of the VIX future.

Why Are VIX Options Priced to VIX Futures?

Options on the VIX are european-style, which means they can’t be exercised until the expiration date. Additionally, they’re cash-settled, as the VIX doesn’t have tradable shares that can be purchased or sold by exercising. So, if you own a 15 call on the VIX and the VIX Index spikes to 30, you can’t exercise your option to buy VIX shares at 15 to sell them at 30. Instead, your P/L is determined by where 30-day implied volatility is expected to be on VIX settlement day, which is represented by the corresponding VIX futures price.

Additionally, VIX options and futures settle to the same number (VRO) at expiration. VRO is a Special Opening Quotation (SOQ) that uses the actual opening prices of SPX options expiring in 30 days in a VIX-style calculation. VRO represents the 30-day implied volatility on the morning of settlement.

A futures contract with no more future/time to settlement must be equal to the spot price (the current market price) of the product that the future represents. So, an implied volatility future at settlement is equal to the actual implied volatility at the time of settlement (the VIX-style calculation at settlement, under the ticker symbol VRO).

VIX Option Settlement Examples

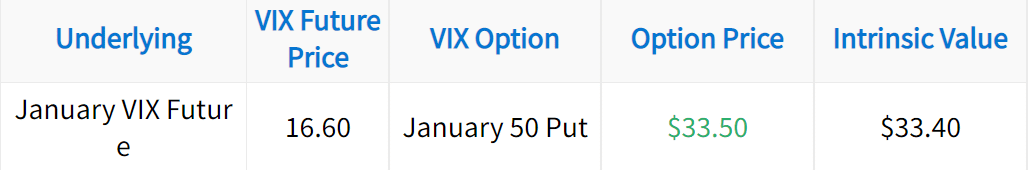

Now that you know the basics of how options on the VIX work, let’s go through some settlement examples.

In the following table, we’ll compare the final settlement value of options on the VIX based on VRO on the day of settlement.

As we can see here, the settlement values of VIX options has nothing to do with the VIX opening price on the morning of settlement. Additionally, VRO is likely to differ from the VIX open because VRO uses the actual opening prices of SPX options on the morning of settlement, as opposed to using the mid-price like the VIX calculation.

Because of this, it may be wise to close profitable VIX option positions on the Tuesday before VIX settlement, as holding through settlement may lead to unfavorable settlement prices.

Additionally, options on the VIX are cash-settled, which means traders with VIX option positions will receive the value of VIX options at expiration, as opposed to shares in the underlying like they would with standard equity options.

For example, if a trader bought the 15 call for $5.00 and the option settled at $8.76, the P/L on the trade would be +$376 per contract: ($8.76 settlement value – $5.00 purchase price) x 100 = +$376.

Short-Term vs. Long-Term VIX Option Sensitivity

When trading VIX options, you might wonder why you don’t just trade the longest-term VIX options to allow more time for your positions to profit.

The answer is that not all VIX options have the same sensitivity to changes in market implied volatility. When examining movements of the VIX Index and futures, you’ll notice that the VIX Index is more responsive to market movements compared to VIX futures with more time until settlement.

As a result, longer-term options on the VIX are less sensitive to changes in implied volatility.

Consider the following visualization of three different VIX futures contracts in 2008:

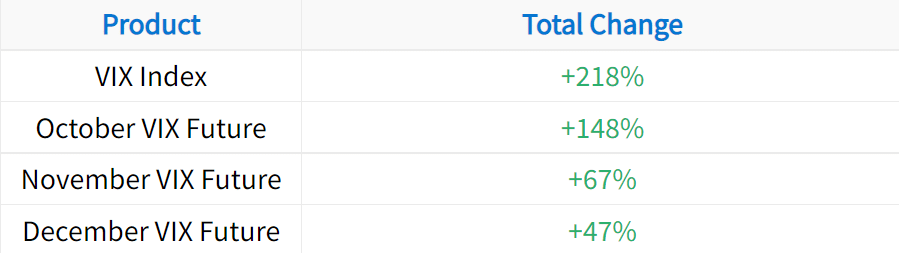

Between September 2nd and October 10th, the following movements occurred in each volatility product:

Let’s compare the changes in the call options with strike prices of 20 over the same period:

As we can see, when the VIX increased from 20 to 70, the October 20 VIX call increased from $3.90 to $35.00, while the December 20 VIX call only increased from $4.20 to $14.10.

While trading long-term options on the VIX might give you more time to be right, volatility will need to experience much more significant changes for your positions to profit.

VIX Options FAQs

The VIX index draws from both call and put options with more than 23 days and less than 37 days to expiration.

The best way to directly bet against the VIX is to use bearish options trading strategies on the VIX itself, such as the bear call spread and bull put spread.

Additionally, investors can purchase SVXY, ProShares Short VIX Short-Term Futures ETF. Because of contango, this ETF tends to shed value faster than the VIX.

projectfinance Options Tutorials

About the Author

Chris Butler received his Bachelor’s degree in Finance from DePaul University and has nine years of experience in the financial markets.

Chris started the projectfinance YouTube channel in 2016, which has accumulated over 25 million views from investors globally.

2 thoughts on “Here’s How to Trade VIX Options (3 Things to Know)”

Thanks for the article!

I’m generally bearish on the VIX. Is it better to trade options on the VIX directly or VIX ETFs?

Thanks for the question Mary!

If you’re long-term bearish on the VIX, trading VIX-based ETFs and ETNs may work out better for you. Why? Over time, these products tend to experience “contango”, which has an adverse effect on the underlying. Most of the time, volatility-based ETFs underperform the VIX.

Hope this helps!

Mike