Last updated on February 9th, 2022 , 10:02 am

In the below guides, projectfinance will teach you everything there is to know about the Greeks in options trading!

Option Greeks 101

If you want to trade options, you must know the Greeks. The good news? They can be simplified. Delta · Gamma · Theta · Vega.

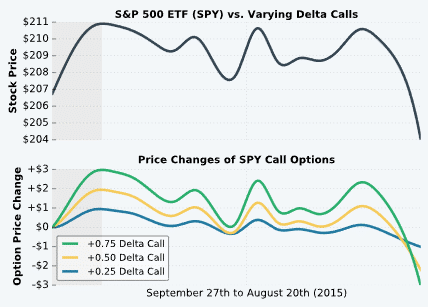

Option Risk #1: Delta

Delta estimates an option’s price change when the stock price rises or falls by $1. In other words, delta is used to gauge an option’s directional exposure.

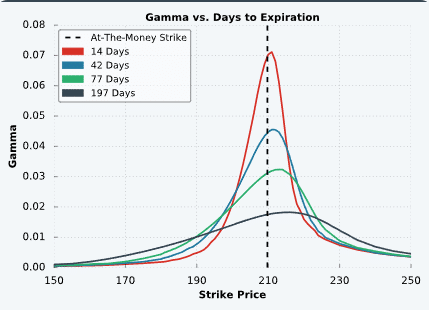

Option Risk #2: Gamma

An option’s directional exposure changes when the stock price shifts. Gamma estimates how much an option’s delta will change when the stock price rises or falls by $1.

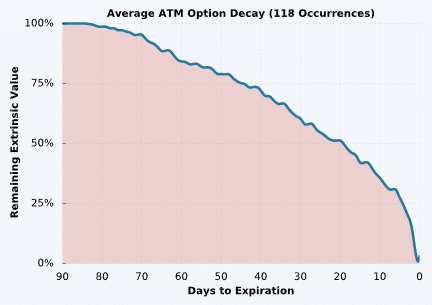

Option Risk #3: Theta

The passage of time is the enemy of option buyers, and the best friend of option sellers. Theta estimates how much an option’s price will fall with each day that passes.

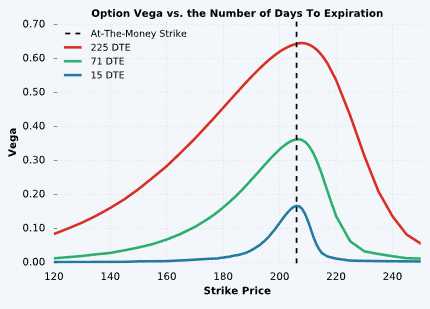

Option Risk #4: Vega

Implied volatility rises and falls with investor sentiment. Vega estimates an option’s price sensitivity relative to changes in implied volatility.

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

Additional Resources

projectfinance Options Tutorials

About the Author

Chris Butler received his Bachelor’s degree in Finance from DePaul University and has nine years of experience in the financial markets.

Chris started the projectfinance YouTube channel in 2016, which has accumulated over 25 million views from investors globally.