Last updated on March 17th, 2022 , 05:44 pm

Options traders often use “moneyness” to describe the relationship between an option’s strike price and the current stock price. Here’s how it works.

Jump To

What is Option Moneyness?

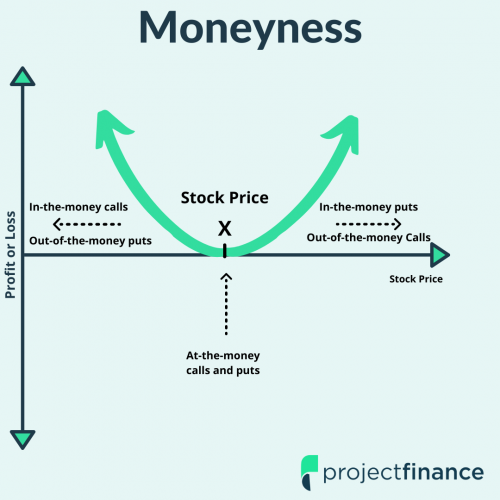

The moneyness of an option refers to three specific options trading terms:

1. In-the-Money

2. At-the-money

3. Out-of-the-money

Let’s quickly discuss each of these terms in regards to call and put options.

What is an “In-the-Money” Option?

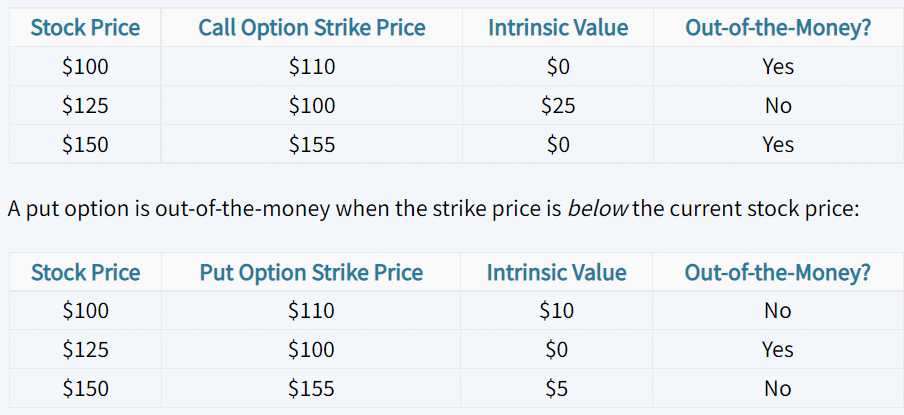

An “in-the-money” option is any option contract that currently has intrinsic value. If you’re unfamiliar with intrinsic and extrinsic value, intrinsic value simply means that the option will be worth something at expiration if the stock price remains at its current level. Let’s take a look at some examples:

As we can see here, call options are “in-the-money” when the call’s strike price is below the current stock price, as that means the call has intrinsic value.

The opposite is true for put options:

As the table suggests, any put option with a strike price above the current stock price is considered in-the-money, as the put option has intrinsic value.

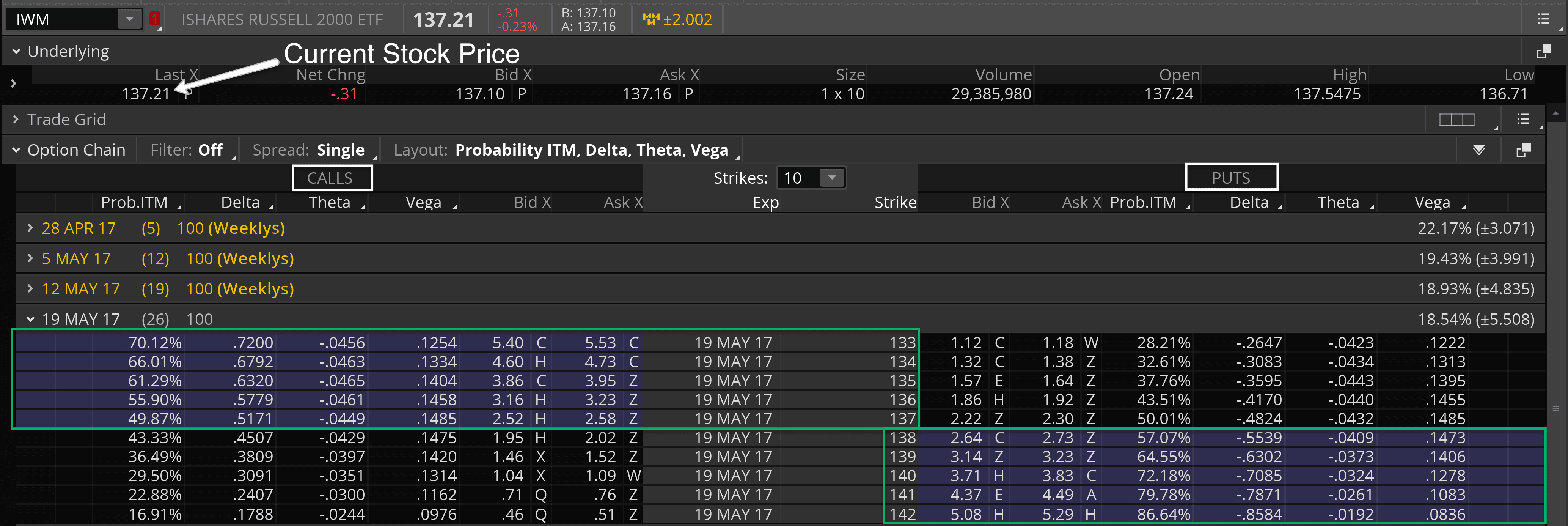

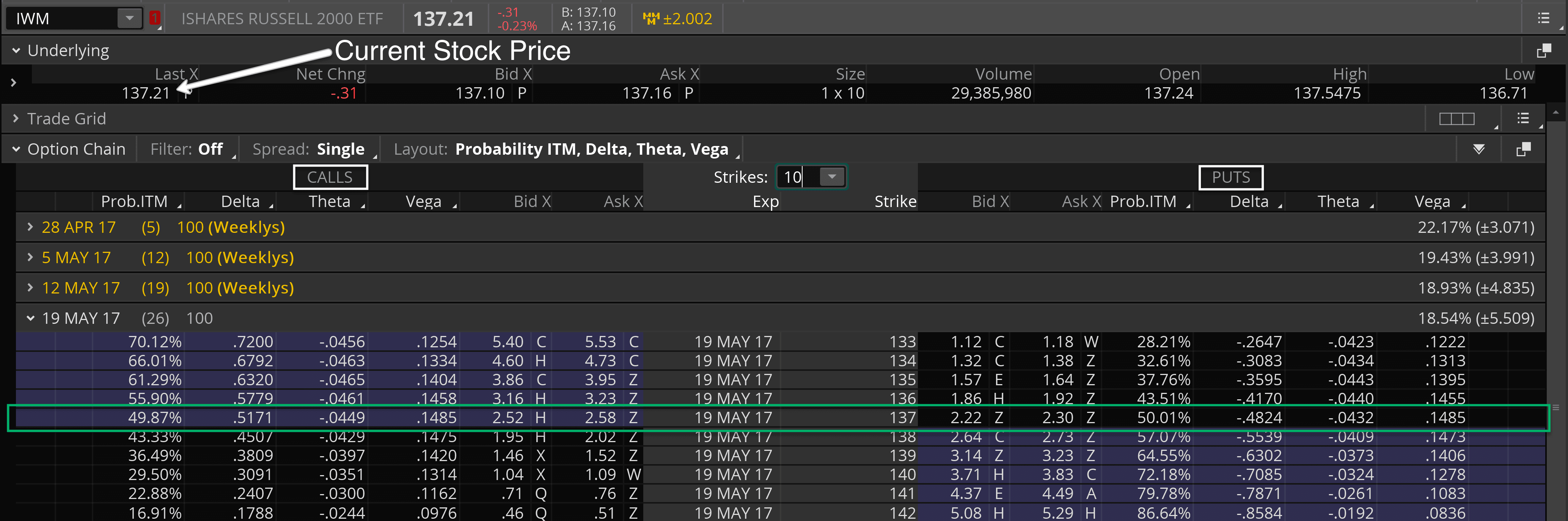

Here’s a picture showing the in-the-money options for IWM when the stock is trading for $137.21:

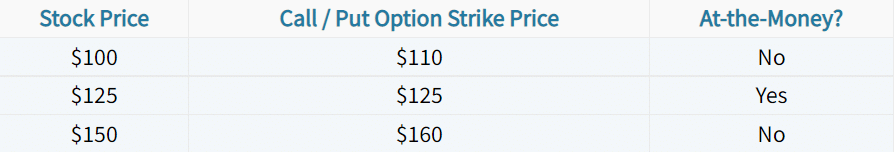

What is an “At-the-Money” Option?

The moneyness of an option is said to be “at-the-money” when the option’s strike price is very close or equal to the current stock price. The concept applies to both call and put options.

Here’s a visual showing the real at-the-money options in IWM with the stock trading at $137.21:

While the 137 call option is technically in-the-money since its strike price is below the stock price, the 137 call would be the call option that’s considered at-the-money.

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

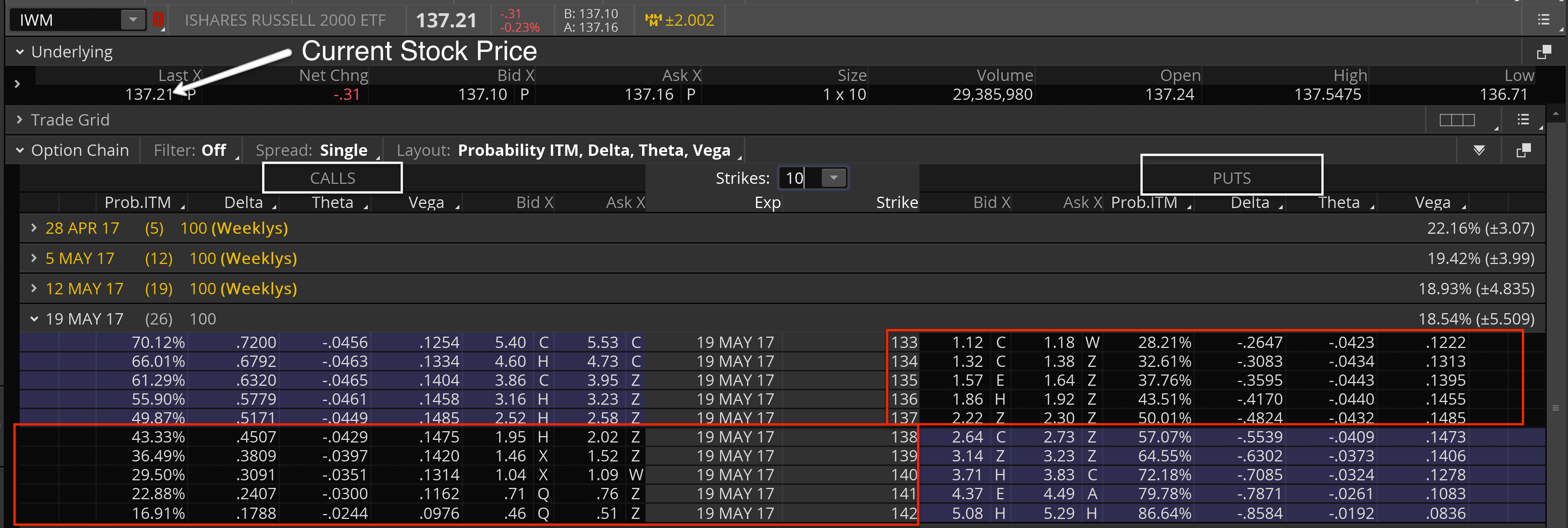

Here’s a snapshot of all the out-of-the-money options with IWM trading at $137.21:

Here’s a snapshot of all the out-of-the-money options with IWM trading at $137.21:

Congratulations! You now know what the moneyness of an option is! Now, you’ll always know what an options trader is talking about when they use the moneyness terms to describe an option.

projectfinance Options Tutorials

About the Author

Chris Butler received his Bachelor’s degree in Finance from DePaul University and has nine years of experience in the financial markets.

Chris started the projectfinance YouTube channel in 2016, which has accumulated over 25 million views from investors globally.