Last updated on February 14th, 2022 , 09:52 am

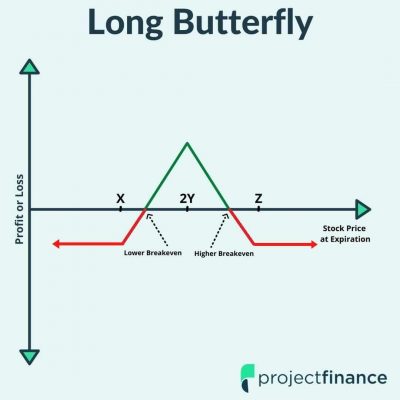

The long butterfly spread is a limited-risk, neutral options strategy that consists of simultaneously buying a call (put) spread and selling a call (put) spread that share the same short strike price. All options are in the same expiration cycle. Additionally, the distance between the short strike and long strikes is equal for standard butterflies.

Butterflies are used when a trader believes the stock price will trade near a certain price in the future, as a butterfly’s maximum profit potential occurs when the stock price trades at the position’s short strike at expiration. Regarding losses, butterflies usually have very low risk because they are cheap, which is represented by the fact that they generally have a low probability of profit. However, butterflies can carry more risk when wider strikes are used.

Lastly, butterflies can be constructed with all calls or puts without changing the risk-reward profile of the position. For example, both of the following long butterfly positions will have the same potential profits and losses:

Call Butterfly:

Long 100/105 Call Spread; Short 105/110 Call Spread (Buy 1x 100 Call, Sell 2x 105 Calls, Buy 1x 110 Call)

Put Butterfly:

Short 100/105 Put Spread; Long 105/110 Put Spread (Buy 1x 100 Put, Sell 2x 105 Puts, Buy 1x 110 Put)

Jump To

TAKEAWAYS

- The long butterfly consists of three parts: buying one call at a lower strike price, selling two calls with a higher strike price and buying one call with a higher strike price.

- To make it a “put” iron butterfly, simply use puts instead of calls for the above inputs.

- The max profit for this trade is the width of the spread – debit paid.

- The max loss is always the total debit paid.

Long Butterfly Options Strategy - General Characteristics

Let’s go over the strategy’s general characteristics:

➥Max Profit Potential:

Long Call Butterfly: (Width of Long Call Spread – Debit Paid) x 100

Long Put Butterfly: (Width of Long Put Spread – Debit Paid) x 100

➥Max Loss Potential: Debit Paid x 100

➥Expiration Breakevens:

➣Upper Breakeven

Long Call Butterfly: Short Strike + (Width of Long Call Spread – Debit Paid)

Long Put Butterfly: Higher Long Put Strike – Debit Paid

➣Lower Breakeven

Long Call Butterfly: Lower Long Call Strike + Debit Paid

Long Put Butterfly: Short Strike – (Width of Long Put Spread – Debit Paid)

➥Position After Expiration

If the call or put butterfly is entirely in-the-money at expiration, the exercise and assignments will offset since there are an equal number of long and short options.

If the butterfly is partially in-the-money, the trader will end up with a stock position at expiration.

Here are the resulting stock positions for a partially in-the-money long call butterfly at expiration:

1 Long Call In-the-Money: +100 shares of stock

1 Long Call and 2 Short Calls In-the-Money: -100 shares of stock

Here are the resulting stock positions for a partially in-the-money put butterfly at expiration:

1 Long Put In-the-Money: -100 shares of stock

1 Long Put and 2 Short Puts In-the-Money: +100 shares of stock

To demonstrate these characteristics in action, let’s take a look at a basic butterfly example.

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

Long Butterfly Profit/Loss Potential at Expiration

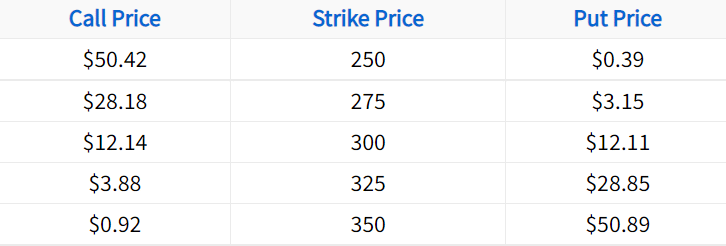

In the following example, we’ll construct a long call butterfly from the following option chain:

To construct a long call butterfly, we’ll have to buy a call spread and sell a call spread that share the same short strike. In other words, we’ll buy one call, sell two calls at a higher strike price, and purchase one call at an even higher strike price.

In this case, we’ll buy the 250 call, sell two of the 300 calls, and buy one of the 350 calls. Let’s also assume the stock price is trading for $300 when we put this trade on:

Initial Stock Price: $300

Short Strike: $300 short call (x2)

Long Strikes: $250 long call, $350 long call

Credit Received for Short Calls: $12.14 x 2 = $24.28

Debit Paid for Long Calls: $50.42 + $0.92 = $51.34

Total Price Paid: $51.34 paid – $24.28 received = $27.06

Before we move on, you’ll notice that the put butterfly using the same strike prices has the same cost:

Long 350 put for $50.89 + Long 250 put for $0.39 = $51.28 debit

Short two 300 puts: $12.11 x 2 = $24.22 credit

Net Debit: $51.28 debit – $24.22 credit = $27.06

Since both the call and put butterfly have the same price and strike widths, they have the same maximum loss potential. Additionally, since they have the same strike widths, they must also have the same profit potential. So, put and call butterflies are identical. For the remainder of this guide, we’ll just use long call butterflies in the examples to keep things simple.

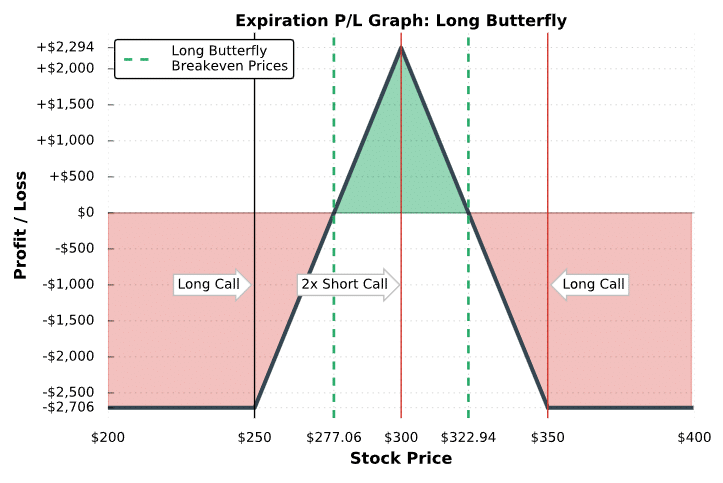

Moving our focus back to the long call butterfly example, the following visual describes the position’s potential profits and losses at expiration:

Long Butterfly at Expiration

As illustrated above, the long call butterfly achieves maximum profit when the stock price is trading at the short strike at expiration, which is a very low probability event. So, making full profit on a long butterfly position should not be expected. With that said, there’s still plenty of profit potential if the stock price is trading somewhere near the short strike at expiration.

Regarding loss potential, the butterfly in this example has a maximum loss potential of $2,706, which is the debit paid x 100. Maximum loss occurs when the stock price is above or below one of the long call strikes at expiration.

Great job! You’ve learned the general characteristics of the long butterfly strategy. Now, let’s go through some visual trade examples to see how the strategy performs through time.

Long Call Butterfly Trade Examples

To visualize the performance of the long call butterfly strategy relative to the stock price, let’s look at a few examples of some options that recently traded. Note that we don’t specify the underlying because butterfly concepts are transferrable to other stocks in the market. Additionally, each example demonstrates the performance of a single position. When trading more contracts, the profits and losses in each case will be magnified by the number of butterflies traded.

Let’s do it!

Trade Example #1: Breakeven Butterfly Purchase

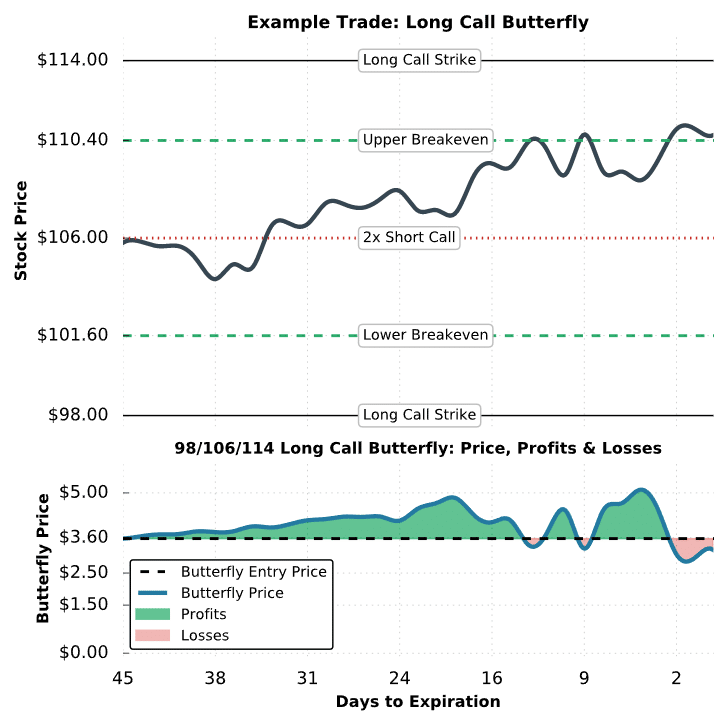

The first example we’ll look at is a scenario where a trader buys a butterfly, but the stock price is near one of the breakevens at expiration.

Here are the trade details:

Initial Stock Price: $105.79

Strikes and Expiration: Short two 106 calls; Long 98 call and 114 call; All options expiring in 45 days

Premium Collected for Short Calls: $2.50 x 2 = $5.00 in premium collected

Premium Paid for Long Calls: $8.46 for the 98 call + $0.14 for the 114 call = $8.60 in premium paid

Net Debit: $8.60 in premium paid – $5.00 in premium collected = $3.60 net debit

Breakeven Prices

Lower Breakeven: $98 long call strike + $3.60 debit paid = $101.60

Upper Breakeven: $106 short strike + ($8-wide call spread – $3.60 debit) = $110.40

Maximum Profit Potential: ($8-wide long call spread – $3.60 debit paid) x 100 = $440

Maximum Loss Potential: $3.60 debit x 100 = $360

Let’s see how the trade performed:

Trade #1 Results

As illustrated here, the 98/106/114 long call butterfly performed well over most of the period because the stock price was relatively close to the short strike, resulting in profits from time decay.

If the trader wanted to lock in profits, they could have sold the butterfly at its price at any point in the trade. If the trader sold the butterfly for $4.50, they would have locked in a profit of $90: ($4.50 sale price – $3.60 initial purchase price) x 100 = +$90.

Unfortunately, the stock price was above the upper breakeven price at expiration and the call butterfly suffered a very small loss.

Regarding a share assignment, this particular trader would have been assigned -100 shares of stock if they did not close one of the in-the-money short calls before expiration. Closing one of the in-the-money short calls would leave the trader with one in-the-money long and short call, which would offset in terms of exercise and assignment. Either way, there’s always a chance that the trader is assigned early on the in-the-money short calls before expiration.

Next, we’ll take a look at a scenario where a butterfly realizes the maximum potential loss.

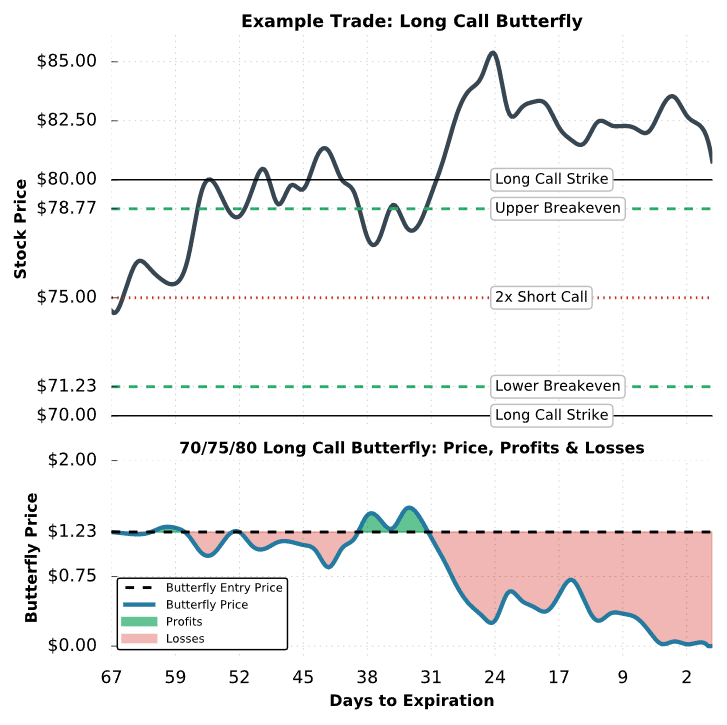

Trade Example #2: Max Loss Butterfly Trade

In the following example, we’ll investigate a situation where the stock price rises continuosly and is above the higher long call strike price of a butterfly at expiration.

Here are the trade details:

Initial Stock Price: $74.44

Strikes and Expiration: Short two 75 calls; Long 70 call and 80 call; All options expiring in 67 days

Premium Collected for Short Calls: $3.10 x 2 = $6.20 in premium collected

Premium Paid for Long Calls: $6.15 for the 70 call + $1.28 for the 80 call = $7.43 in premium paid

Net Debit: $7.43 in premium paid – $6.20 in premium collected = $1.23 net debit

Breakeven Prices

Lower Breakeven: $70 long call strike + $1.23 debit paid = $71.23

Upper Breakeven: $75 short strike + ($5-wide call spread – $1.23 debit) = $78.77

Maximum Profit Potential: ($5-wide long call spread – $1.23 debit paid) x 100 = $377

Maximum Loss Potential: $1.23 debit x 100 = $123

Let’s take a look at what happens:

Trade #2 Results

As we can see here, the long call butterfly did not do well because the stock price increased significantly over the trade period. At expiration, the call butterfly was fully in-the-money. Consequently, the buyer of the call butterfly realized the maximum loss potential since the butterfly wasn’t worth anything at expiration.

Regarding a share assignment, all of the in-the-money calls would offset at expiration. However, there’s a chance that the trader in this example is assigned early on the two in-the-money short calls before expiration.

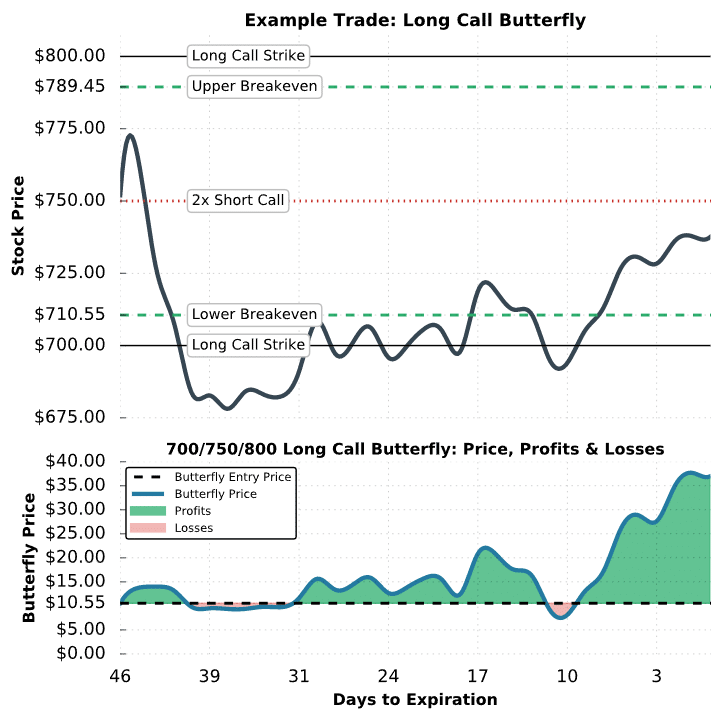

Trade Example #3: Highly Profitable Butterfly Purchase

In the final example, we’ll look at a scenario where a long butterfly trader makes almost full profit at expiration.

Here are the trade details:

Initial Stock Price: $752

Strikes and Expiration: Short two 750 calls; Long 700 call and 800 call; All options expiring in 46 days

Premium Collected for Short Calls: $37.30 x 2 = $74.60 in premium collected

Premium Paid for Long Calls: $68.40 for the 700 call + $16.75 for the 800 call = $85.15 in premium paid

Net Debit: $85.15 in premium paid – $74.60 in premium collected = $10.55 net debit

Breakeven Prices

Lower Breakeven: $700 long call strike + $10.55 debit paid = $710.55

Upper Breakeven: $750 short strike + ($50-wide call spread – $10.55 debit) = $789.45

Maximum Profit Potential: ($50-wide long call spread – $10.55 debit) x 100 = $3,945

Maximum Loss Potential: $10.55 debit x 100 = $1,055

Let’s see what happens!

Trade #3 Results

In this example, the 700/750/800 long call butterfly performed very well because the stock price was near the short strike at expiration.

More specifically, the stock price was trading for $737.60 at expiration, resulting in an expiration value of $37.60 for the 700/750/800 call butterfly (since the 700 call expired worth its intrinsic value of $37.60 and the other calls expired worthless).

Since the initial purchase price was $10.55, the expiration profit would be $2,705: ($37.60 expiration value – $10.55 purchase price) x 100 = +$2,705.

At expiration, this position would expire to +100 shares of stock since only the 700 call expired in-the-money. If the trader did not want to be long shares after expiration, the long 700 call would need to be sold before expiration.

Final Word

Congratulations! You should now feel much more comfortable with how the long butterfly works as a trading strategy. Let’s recap what we learned:

- The long butterfly is a limited risk, market neutral trade.

- To construct a long call butterfly, we’ll have to buy a call spread and sell a call spread that share the same short strike.

- Max profit is the spread width, minus the debit paid.

- Max loss is the debit paid.

projectfinance Options Tutorials

About the Author

Chris Butler received his Bachelor’s degree in Finance from DePaul University and has nine years of experience in the financial markets.

Chris started the projectfinance YouTube channel in 2016, which has accumulated over 25 million views from investors globally.