Last updated on March 2nd, 2022 , 07:57 am

Sometimes, you’ll need to make an adjustment to your option positions when the stock price moves against you.

In this post, we’re going to discuss the short strangle adjustment strategy of “rolling up” the short put options.

Jump To

What is "Rolling an Option?"

Rolling an option is the process of closing an existing option and opening a new option at a different strike price or in a different expiration cycle. This generally happens when in-the-money options are expiring.

Today, we’ll focus on “rolling up” the short put option in a short strangle position, which refers to buying back your current put option and “rolling it up” by selling a new put at a higher strike price.

When Do You Roll Up the Put?

Let’s talk about when a trader would most likely roll up the short put.

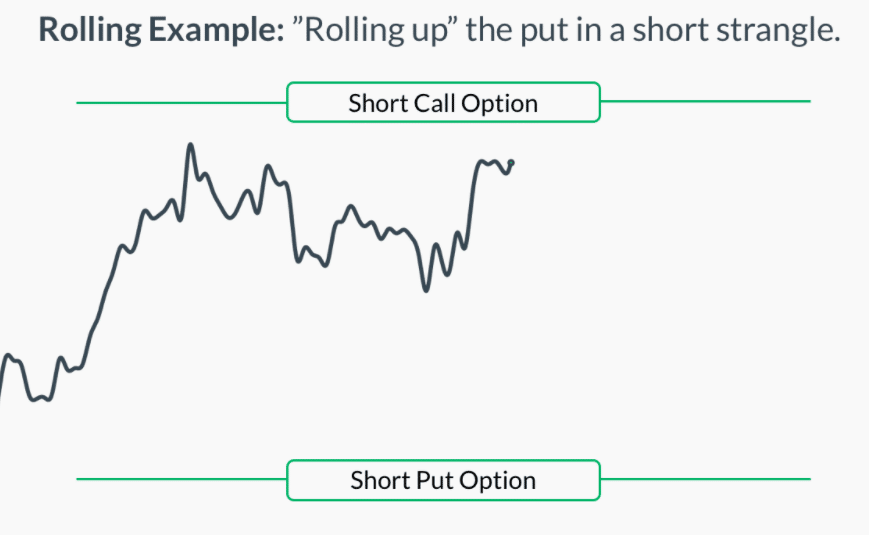

Consider the following visual:

As we can see, the stock price is rising quickly and approaching the short call’s strike price. Since short strangles have negative gamma, the position’s delta grows negative as the stock price trends towards the short call.

The result?

The trader starts to lose more and more money as the stock price continues to increase.

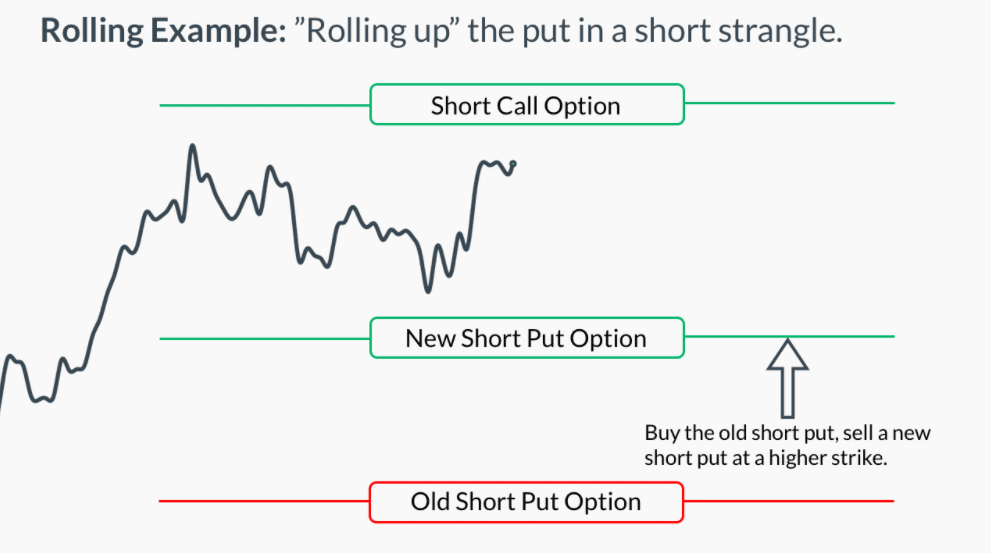

The most common short strangle adjustment to make in this scenario is to roll up the short put option:

To roll up the short put option, a trader simply has to buy back their current short put option and sell a new put option at a higher strike price (in the same expiration cycle).

What Does Rolling Up the Puts Accomplish?

By rolling up the short put option in a short strangle position, a trader accomplishes two things:

1. Collect more option premium since the new put you sell is more expensive than the put you buy back.

2. Your position’s delta becomes more neutral, which means you’ll lose less money if the stock price continues to increase.

Let’s cover each of these points in more depth.

#1: Collect More Option Premium

Consider a trader who is short the 220 put option in their short strangle position, but rolls the 220 put to the 235 put:

Put Strike Price | Option Price | Delta | Trade |

|---|---|---|---|

235 | $1.60 | -0.30 | Sell (Open) |

230 | $0.85 | -0.16 | |

225 | $0.50 | -0.09 | |

220 | $0.31 | -0.06 | Buy (Close) |

Since the trader buys back the 220 put for $0.31 and sells the 235 put for $1.60, they collect additional option premium from rolling up the put:

Premium Collected:

$1.60 Collected – $0.31 Paid Out = +$1.29

In dollar terms, the additional $1.29 in premium means the maximum profit on the trade increases by $129 per short strangle, and the upper breakeven point is also extended $1.29 higher.

As a result, the stock price can increase even further than it could before and the trade can still be profitable.

#2: Neutralize Your Position Delta

By rolling up the put option, the position also becomes more neutral.

Let’s say that at the time of the roll, the short strangle’s position delta is -44 (the trader is expected to lose $44 from a $1 increase in the stock price, and make $44 from a $1 decrease in the stock price).

Here’s how the position delta would change after the rolling adjustment from the previous example:

Put Strike Price | Option Price | Delta | Trade |

|---|---|---|---|

235 | $1.60 | -0.30 | Sell (Open) |

220 | $0.31 | -0.06 | Buy (Close) |

Old Put Position Delta: +6 (-0.06 Put Delta x $100 Option Multiplier x -1 Contract)

New Put Position Delta: +30 (-0.30 Put Delta x $100 Option Multiplier x -1 Contract)

Change in Position Delta: +24

New Short Strangle Position Delta: -44 + 24 = -20

After rolling up the short put, the position delta becomes more neutral.

With a new position delta of -20, the trader is only expected to lose $20 if the stock price increases by $1, as opposed to a $44 loss before the roll.

Of course, this also means the trader is only expected to gain $20 from a $1 decrease in the share price, as opposed to a $44 gain before the short strangle adjustment.

With that said, it’s clear that it’s not all peachy when it comes to rolling up the short put. Let’s talk about the downsides of rolling up.

What's the Risk of Rolling Up the Put?

While rolling up a short put increases the option premium received (higher maximum profit potential) and neutralizes your position delta, there are some downsides:

1. You decrease the range of maximum profitability, as your new put’s strike price is much closer to the short call’s strike price.

2. The position delta gets neutralized, which means a reversal in the stock price results in less profits than if the rolling adjustment wasn’t made. Even worse, the position delta will start to grow positive if the stock price continues to fall after rolling up the put (resulting in losses if the stock keeps falling).

As with any trade adjustment, there are benefits and downsides. However, if you’re looking for a short strangle adjustment to help reduce the directional risk after a rally in the stock price, then rolling up the short put is one option available to you (pun intended).

Concept Checks

Here are the essential points to remember the short strangle adjustment of rolling up the short puts:

- When selling strangles, if the share price appreciates towards your short call, you can adjust the position by “rolling up” the short put (buy back the old short put, sell a new put at a higher strike price).

- By rolling up the old put, you increase the amount of option premium collected and neutralize your position delta (resulting in a higher upper breakeven point and less notable losses if the stock price continues to rise).

- The downside of rolling is that you decrease the range of maximum profitability since your new put strike is closer to the short call’s strike price. Additionally, you’ll make less money (or potentially lose money) from reversals in the stock price after rolling.

Next Lesson

Additional Resources

projectfinance Options Tutorials

About the Author

Chris Butler received his Bachelor’s degree in Finance from DePaul University and has nine years of experience in the financial markets.

Chris started the projectfinance YouTube channel in 2016, which has accumulated over 25 million views from investors globally.